Navigating Offshore Count On Solutions: Exactly How to Pick the most effective Offshore Trustee

So, you've made a decision to venture into the world of offshore trust fund services. Currently comes the challenging part - choosing the ideal overseas trustee. We will certainly discover aspects such as understanding overseas trust funds, assessing trustee online reputation, examining trustee experience, and considering administrative aspects.

Understanding Offshore Trusts

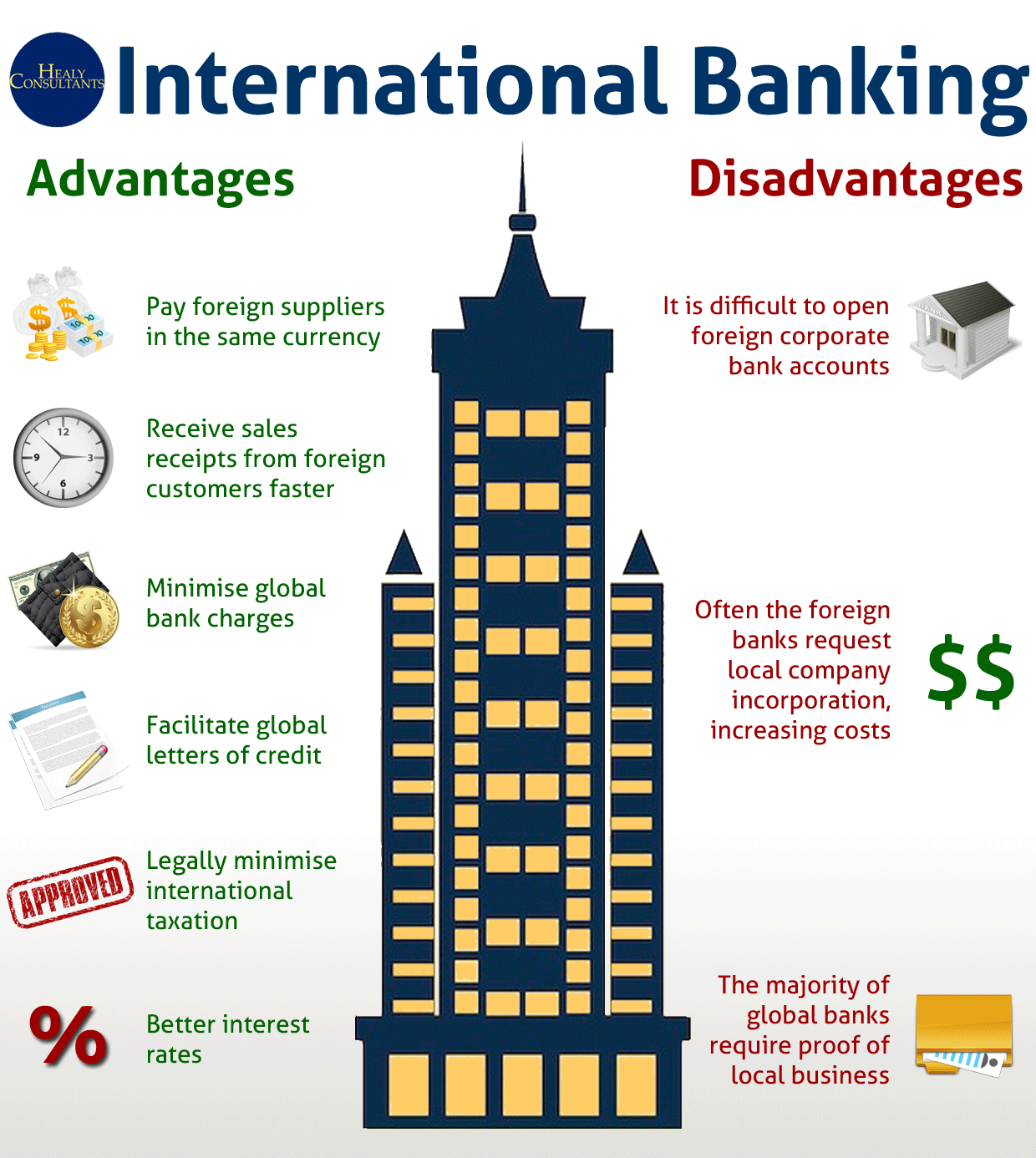

Offshore trusts are legal entities that allow people to protect and manage their assets in a secure and confidential way. By positioning your possessions in an offshore depend on, you can secure them from lawful cases and possible creditors.

An additional benefit of overseas counts on is tax preparation (offshore trustee). Several offshore territories offer beneficial tax regimes, allowing you to minimize your tax obligation liability and optimize your riches. By developing an offshore count on, you can take advantage of these tax advantages and legally decrease your tax obligation problem

Examining Trustee Reputation

First, take into consideration the online reputation of prospective overseas trustees prior to making a choice. A reliable overseas trustee will have a strong background of efficiently working and managing trusts with clients.

To assess a trustee's reputation, start by carrying out thorough study. In addition, consider their experience and experience in taking care of offshore depends on.

Additionally, you can look for suggestions from specialists in the area, such as legal representatives or financial advisors. They might have understandings right into the online reputation and performance of various overseas trustees based on their own experiences and communications.

Assessing Trustee Experience

When analyzing offshore trustees for your overseas trust fund, you must meticulously consider their level of experience in working and handling trust funds with customers. Experience plays an essential function in guaranteeing that your depend on is taken care of properly and according to your goals. Seek trustees who have a tested performance history in the sector and a strong understanding of the complexities involved in offshore trust services.

A trustee with extensive experience will certainly have the expertise and skills to navigate the ever-changing landscape of offshore guidelines and tax obligation laws. They will certainly be able to provide you with specialist guidance on structuring your depend on to optimize its benefits and safeguard your properties. Furthermore, a seasoned trustee will certainly have established partnerships with banks and professionals in the overseas industry, which can be beneficial in facilitating the administration of your count on.

Taking Into Consideration Administrative Aspects

Consider the jurisdictional variables when choosing an offshore trustee for your overseas trust. The option of jurisdiction for your depend on is a critical choice that can have substantial effects for the success and defense of your possessions. Various territories use differing degrees of personal privacy, possession security, and tax obligation advantages.

One crucial factor to think about is the lawful and regulative framework of the territory. You intend to make certain that the territory has secure and strong regulations that safeguard your properties and protect your rate of interests - offshore trustee. In addition, it is vital to analyze the economic and political security of the territory to decrease any type of prospective dangers

An additional factor to take into consideration is the level of confidentiality and personal privacy provided by the jurisdiction. Some territories have rigorous privacy laws that protect the identification of the settlor and beneficiaries, while others might have much less rigid policies. Relying on your details requirements and choices, you may wish to choose site a jurisdiction that offers a high degree of personal privacy and confidentiality.

Tax obligation factors to consider are likewise crucial when picking a jurisdiction for your overseas trust fund. Some territories offer favorable tax regimens, such as low or no tax obligations on depend on revenue and funding gains. It is necessary to analyze the tax implications in both the territory of the trust fund and your very find more information own country of residence to ensure that you can take full advantage of tax efficiency.

Making an Educated Decision

After considering the jurisdictional aspects, it is important for you to collect all the required details and make an educated decision when selecting the ideal offshore trustee for your overseas trust. Choosing the best trustee is a substantial choice that can significantly influence the success of your overseas trust fund. To make an enlightened selection, begin by completely looking into and evaluating prospective trustees. Seek trustees with a solid credibility and substantial experience in taking care of offshore counts on. It is additionally important to examine their level of knowledge in the details jurisdiction where you plan to develop your count on. Consider their track document, certifications, and any type of accreditations they may hold. Additionally, put in the time to review their procedures and policies, ensuring they straighten with your goals and values. Credibility and integrity are crucial qualities to seek in a trustee, as they will certainly be accountable for securing your properties and choosing that straighten with your dreams. Think about looking for suggestions and testimonials from various other depend on beneficiaries who have worked with the trustee in concern. By collecting all the essential information and carrying out complete due persistance, you can make an informed decision and pick the best offshore trustee for your offshore depend on.

Conclusion

Since you have all the info you require, you can confidently pick the most effective offshore trustee for your requirements. By recognizing offshore counts on, reviewing the credibility and experience visite site of trustees, thinking about administrative aspects, and making an informed decision, you can guarantee that your properties remain in risk-free hands. Count on your reactions and make the best choice for your economic future.

We will certainly check out aspects such as recognizing overseas counts on, evaluating trustee track record, assessing trustee experience, and considering administrative elements.When assessing offshore trustees for your overseas trust fund, you need to carefully consider their degree of experience in handling depends on and working with customers.Think about the jurisdictional factors when choosing an offshore trustee for your offshore trust fund.After taking into consideration the administrative elements, it is critical for you to collect all the needed details and make an educated choice when choosing the best overseas trustee for your overseas trust fund. By gathering all the essential information and carrying out complete due persistance, you can make an informed decision and select the best overseas trustee for your overseas trust.